Published on 2025-10-22T21:12:00.000Z by Unigox Team

MegaETH (MEGA) Pre-Market Trading Now Live: What the Linea Launch Teaches Us About Early Opportunities

TL;DR: MegaETH perpetual futures went live on Hyperliquid today (October 22, 2025), nine days before its public ICO launches October 27-30. Pre-market trading is now accessible through platforms like UNIGOX, which offers integrated Hyperliquid trading with seamless fiat on/off-ramps. History suggests these early trading windows create unique opportunities.

Linea (Blockchain) token launch pre-market period showed similar patterns worth understanding.

The Linea Case Study: What Actually Happened

Linea ($LINEA) launched September 10, 2025, and its pre-market trading period offers useful context for understanding these early windows.

The Timeline

September 1, 2025: Hyperliquid and Binance opened LINEA pre-market perpetuals 9 days before token generation. Traders could start speculating on the price before any real market existed.

September 10, 2025 (Launch Day):

- Listing price: $0.0345

- Intraday high: $0.0466

- End of day: 0.023−0.023−0.025

- Day 1 movement: Significant volatility with 25-30% swings from the listing price

What Drove the Price Action

Linea distributed 9.36 billion tokens (60% of the initial supply) via airdrop to 750,000 recipients with zero vesting. This created immediate sell pressure as recipients who received tokens for free had no cost basis to defend.

The Extended Pattern

The volatility didn't stop on day one:

- September 12: Declined to $0.0218

- October 10: Hit $0.0072 (79% below launch price)

- October 22 (today): Trading around $0.0167

Current status: LINEA trades 52% below its September 10 listing price more than 40 days later.

Key Lesson from Linea

Pre-market trading created a 9-day window where traders could position before the supply shock. Those who understood the tokenomics massive airdrop, no vesting, low cost basis, had time to prepare for launch-day dynamics.

The pattern: Pre-market opens → Speculation drives initial pricing → Token launches → Fundamentals (supply/demand) reassert themselves

MegaETH: Different Structure, Similar Window

No airdrop dump dynamic: MegaETH has no free token distribution. ICO participants pay real money and establish an actual cost basis, changing post-launch behavior.

Quality backing: Vitalik Buterin's personal involvement and Dragonfly Capital's institutional support signal long-term commitment, not a quick airdrop exit.

Lower initial float: Just 5% of supply in public sale (500M of 10B tokens) means tighter initial supply, though this creates unlock risk later.

What's Similar

Pre-market speculation: Like Linea, MEGA is trading before fundamentals exist. No mainnet, no TVL, no real users—pure speculation on future potential.

The timing gap: Same 5-9 day window between pre-market opening and ICO completion creates an opportunity for informed positioning.

Volatility expectations: Pre-launch perpetuals historically trade with extreme volatility as participants react to news, rumors, and sentiment shifts.

Understanding Pre-Market Perpetual Dynamics

Pre-market perpetual contracts work differently from standard futures because there's no underlying spot market to reference.

How Hyperliquid's "Hyperps" Work

Normal perpetual contracts use an index price that averages multiple spot exchanges. If the perpetual trades above/below this index, funding rates incentivize it back toward equilibrium.

Pre-market perpetuals can't reference spot markets that do not exist yet. Hyperliquid's solution:

- Uses an 8-hour exponentially weighted moving average of its own mark prices

- Mark price capped at 4x initial price (prevents manipulation)

- Maximum 3x leverage (isolated margin only)

- Funding rates based on deviation from the moving average

What This Means for Traders

Funding rate costs: If you hold positions for weeks, you'll pay or receive funding every 8 hours. On hyped tokens, funding can be 0.1-0.3% per cycle (9-27% monthly), eating into profits even if the directional thesis is correct.

Higher volatility: Without spot market anchors, price discovery is pure speculation. 20-30% daily swings are common.

Conversion at launch: When MEGA launches on major exchanges, Hyperliquid converts the Hyperps contract to standard perpetual using actual spot prices.

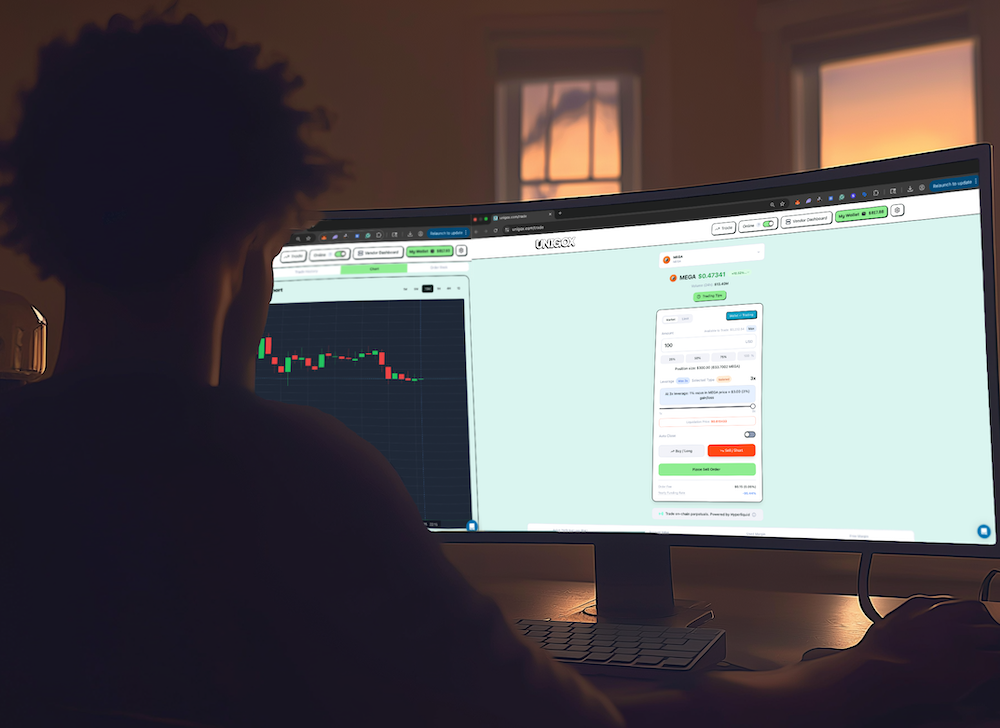

How to Access MEGA Trading on UNIGOX

UNIGOX integrated Hyperliquid perpetuals in October 2025, offering streamlined access to pre-market opportunities like MEGA with features designed for ease of use.

The UNIGOX Advantage

Integrated trading interface: Rather than bridging between platforms, UNIGOX embeds Hyperliquid trading directly into a simple, mobile-friendly interface. Move funds between your UNIGOX wallet and Hyperliquid trading balance with one click.

Multi-chain deposit support: Fund your account via:

- Ethereum mainnet

- Solana

- Arbitrum

- Base

- Optimism

- Hyperliquid EVM

- 2+ additional chains

Automated P2P fiat on-ramp: UNIGOX allows you to deposit local currency and receive USDC in ~60 seconds:

- No chat interfaces or manual vendor selection

- Automated matching with verified vendors (businesses and individuals)

- ZK-TLS fraud protection

- Supports currencies like Nigerian Naira (NGN), Kenyan Shilling (KES), EURO, GBP, and more

- Competitive rates through vendor competition

Seamless cashout: Convert trading profits to local currency and withdraw to your bank account using the same P2P infrastructure.

Why This Matters for Pre-Market Trading

Time is critical in pre-market windows. The 5-9 days between now and MEGA's ICO mean slow on-ramps and missed opportunities.

Traditional flow:

- Buy crypto on CEX, wait till money clears

- Withdraw to wallet (wait for confirmations)

- Bridge to Arbitrum/Hyperliquid (gas fees, wait times)

- Connect your wallet to Hyperliquid

- Manually manage collateral

UNIGOX flow:

- Deposit fiat via P2P (60 seconds to USDC)

- One-click transfer to Hyperliquid trading balance

- Trade MEGA perpetuals

- One-click withdrawal to the main wallet

- Cash out to the local bank via P2P

For users in regions with limited crypto access (Nigeria, Kenya, etc.), this infrastructure removes the biggest barrier to participating in pre-market opportunities.

Comparison to Other Platforms

Direct Hyperliquid access: Full functionality but requires existing crypto, bridging knowledge, and manual collateral management.

MetaMask/Phantom integrations: Convenient for existing users of those wallets, but no fiat on-ramp and no seamless trading interface. Still requires understanding bridges and gas.

UNIGOX: Combines Hyperliquid access with infrastructure that handles the "getting money in and out" problem that blocks most users from acting quickly on opportunities.

Setting Up Your UNIGOX Account for MEGA Trading

Step 1: Create Account & Wallet

Visit UNIGOX and create an account. You'll get a non-custodial wallet that supports 8+ chains, including Hyperliquid EVM.

Step 2: Fund Your Account

Option A - Crypto Deposit:

- Navigate to the wallet deposit

- Select your chain (Arbitrum, Base, Solana, etc.)

- Send USDC to your UNIGOX wallet address

Option B - Fiat Deposit (Recommended for speed):

- Go to the P2P widget

- Select your local currency and amount

- The system automatically matches you with a verified vendor

- Complete payment via local bank transfer/mobile money

- Receive USDC in ~60 seconds

Step 3: Transfer to Trading Balance

- Open the Trading tab on UNIGOX

- Click "Transfer to Trading"

- Funds move from the main wallet to the Hyperliquid trading balance.

- No bridging, no gas fees, one click

Step 4: Trade MEGA Perpetuals

- Navigate to the trading interface

- Search for MEGA

- Set your position size and leverage (max 3x)

- Execute long or short positions based on your analysis

Step 5: Manage & Exit

- Monitor position in real-time on mobile or desktop

- Close position when desired

- Funds return to the main wallet with one click

- Cash out via P2P to local currency if desired

Risk Considerations for Pre-Market Trading

Pre-market perpetuals carry unique risks beyond standard derivatives trading:

1. Extreme Volatility

Without spot market anchors, MEGA can swing 20-30% on rumors alone. Position sizing should account for this volatility.

2. Funding Rate Costs

Holding positions for weeks accumulates funding costs.

3. Liquidation Risk

Even with 3x leverage caps, a 33% adverse move liquidates your position. Given pre-market volatility, this can happen quickly.

Strategic Approaches to MEGA Pre-Market

Rather than prescribing specific positions (we're not providing financial advice), here are frameworks traders commonly use:

The Comparison Analysis Approach

Build valuation models comparing MEGA to similar L2 projects:

- Arbitrum: ~$2.3B FDV, established ecosystem

- Optimism: ~$1.8B FDV, proven tech

- Base: Coinbase-backed, massive user base

Assess whether pre-market pricing aligns with realistic launch valuations given MEGA's stage (pre-mainnet, zero TVL, zero users).

Sector Saturation Risk

With Linea, Berachain, Monad, and MegaETH launching in 2025, sector saturation is something to be mindful of.

Disclaimer

This article is for informational and educational purposes only. It does not constitute financial advice, investment advice, trading advice, or a recommendation to buy or sell any asset.

Pre-market perpetual futures trading involves substantial risk of loss and is not suitable for all investors. You can lose more than your initial investment. Leverage amplifies both gains and losses.

Past performance (including the Linea case study) does not guarantee future results. Every token launch has unique characteristics and market conditions.

UNIGOX is a platform providing infrastructure; it does not provide investment advice. Users are responsible for their own trading decisions and risk management.

Always conduct your own research, understand the risks, and never invest more than you can afford to lose. Consider consulting with a qualified financial advisor before making investment decisions.

The authors may or may not hold positions in the mentioned assets. Geographic restrictions apply to Hyperliquid trading. Check your local regulations before trading derivatives.

Written by Unigox Team

← Back to blog